- #Profit and loss google sheets template how to#

- #Profit and loss google sheets template professional#

Use the SUM formula to calculate the total expenses for each month and for the whole period.īelow Expenses, calculate the profit or loss for each month by subtracting the total expenses from the total income.

Enter the amounts for each month in separate columns. Under Expenses, list all the costs incurred by your business, such as accounting, advertising, depreciation, rent, wages, etc. Use the SUM formula to calculate the total income for each month and for the whole period. Under Income, list all the sources of revenue for your business, such as sales, services, or other income. Open a new Google Sheet or use our free P&L template.Įnter your business name, address, and the period covered by the statement at the top of the sheet.Ĭreate two main sections: Income and Expenses.

#Profit and loss google sheets template how to#

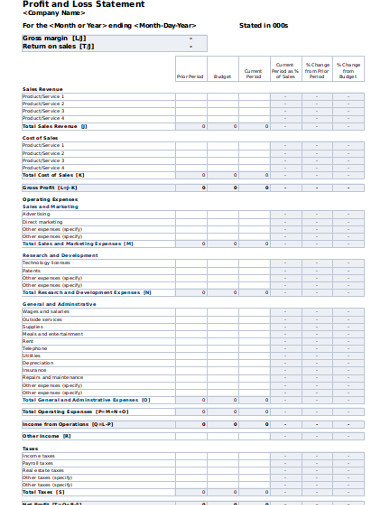

How to create a profit and loss statement in Google Sheets Analyze the data to identify trends, areas of improvement, and potential growth opportunities. Review and analyze: Review the completed P&L statement for accuracy and consistency. Include headings for each category (revenue, COGS, operating expenses, non-operating income and expenses, and net income) and list the corresponding figures beneath each heading.

#Profit and loss google sheets template professional#

This categorization will help streamline the process of creating the P&L statement.Ĭalculate key figures: Using the organized data, calculate the following key figures.įormat the P&L statement: Create a professional and easy-to-read P&L statement by formatting the data in a clear and organized manner. Organize data: Organize the financial data into the appropriate categories: revenue, COGS, operating expenses, and non-operating income and expenses. Ensure that you have accurate and complete records to avoid errors in your P&L statement. Choose a reporting period: Determine the time frame for which you want to create the P&L statement, such as a fiscal quarter or year.Ĭompile financial data: Gather all relevant financial data for the chosen reporting period, including sales, COGS, operating expenses, non-operating income, and non-operating expenses.

0 kommentar(er)

0 kommentar(er)